How many payment methods should you have on your website?

Not sure?

Whether you are starting out or looking to expand your business, choosing what eCommerce payment methods to offer can be a make-or-break decision.

If you don’t give potential customers what they want, you will very likely experience higher cart abandonment.

Abandoned carts means less profit and nobody wants that!

Statista predicts the retail eCommerce industry will reach $6.3 trillion worldwide by 2023 and $8.1 trillion by 2026.

If you have a variety of payment options on your website, your store could be a part of those growth statistics.

This article will help you learn about the many different online payment methods and how they can be seamlessly integrated with SureCart.

Let’s begin by understanding what eCommerce payment systems are.

Understanding electronic payment systems

Electronic payment systems, eCommerce payment methods, or online payment methods, the terms are used interchangeably.

The moment a customer clicks on the Pay Now button on a checkout page, a series of actions take place behind the scenes.

This involves a number of entities that work together to transfer funds from a customers’ bank to your merchant bank account.

Although the process is complex, it takes just three seconds to complete.

Here’s who’s involved:

- Merchant: The business owner (you) selling products or services

- Consumer: The one who charges the card online to buy items from the merchant

- Gateway: A link between an eCommerce website and a payment processor to transfer sensitive data such as credit card information

- Payment processor: The entity responsible for transferring transaction data between the customer and seller

- Card network: A company that facilitates the payment of credit or debit cards such as Mastercard, Discover, or Visa.

- Issuing bank: A bank that extends credit and issues a credit card to a consumer

What appears to be a smooth process is the result of well-coordinated actions by all these entities.

To better understand the whole thing, let’s look at a real-life scenario of a credit card transaction.

Home Goods is an eCommerce store that sells high quality general home items. Laila, a customer, wants to purchase a rug that’s on sale for $15 with Mastercard.

Home Goods has already integrated a payment gateway and processor into their online store.

Here’s how the purchase process works:

- Laila will fill in the essential data on the checkout page including Mastercard information and click the Pay Now button.

- The payment gateway will collect and encrypt the payment information before forwarding it to the payment processor.

- Since Laila uses Mastercard, the payment processor will pass on this payment information to the Mastercard network.

- Mastercard will reach out to the credit card issuer (the issuing bank that issued Laila the card) to authenticate the transaction. The issuing bank checks the availability of funds in the account. If everything is in order, the bank will debit the customer’s card.

- The issuing bank will inform Mastercard that the customer is authorized to use $15 for the purchase. At the same time, it will send a confirmation message to the customer that their card is being debited.

- The card network will forward transaction confirmation to the payment processor and the gateway

- The payment gateway will inform Home Goods that everything is OK. The store will now confirm to the customer that their desired item is on its way to the delivery address.

As we mentioned before, all communication happens in around 3 seconds for the majority of transactions.

The importance of having multiple payment methods

The more payment methods you offer, the better the overall customer experience.

Integrating multiple payment options can have the following benefits.

More conversions

The primary benefit of adding more payment methods to your checkout page is to encourage more conversions.

The easier it is to buy, the more likely someone will do it. That includes offering payment methods that customers prefer to use.

Wider audience

In some regions, certain payment methods are more popular than others. If you fail to include them, you risk losing customers.

For example, Cartes Bancaires is a very popular payment option in France. You would like to add it to give local consumers an option they prefer.

User convenience

Some payment methods are more convenient than others. It’s easy to tap and pay instead of pulling out a credit card and entering information.

Payment methods such as Apple Pay are prime examples of how conveniently users can pay with just a single click.

Payment backups

Payment failures can happen at any time. An API issue, declined credit card or expired card are some of the many common issues you can face.

If you have a single payment method on the website and something happens, this will very likely lead to losing the sale.

Having multiple online payment methods can avoid that.

For example, if a customer faces a declined credit card, they can use a digital wallet or direct debit to complete the purchase.

How SureCart is shaking up eCommerce

SureCart is an extremely powerful eCommerce plugin and offers support for multiple payment methods. The plugin integrates seamlessly with all popular payment gateways and processors.

Whether you want a digital wallet, express payment solution or other eCommerce payment system, SureCart has you covered.

Besides being a powerful plugin, SureCart is extremely easy to configure.

Anyone can set up the plugin and integrate payment methods in a few clicks, thanks to a user friendly setup wizard.

A few other benefits of SureCart:

- Speed: SureCart is a cloud-based solution where you create stores, save products and process eCommerce activities on its servers while the storefront appears on your website.

- For any eCommerce store: Whether you run a blog or large eCommerce store, SureCart is suitable for any project

- Integration: SureCart integrates seamlessly with most WordPress themes and plugins

- Customization: With SureCart you can customize checkout forms, carts and customer dashboards any way you want

- Powerful combination: SureCart works perfectly with the Astra theme, Spectra page builder, SureTriggers and SureMembers

- Security: The plugin offers inbuilt security tools to keep your data safe all the time

If you want to learn more about how SureCart can help your business and how to install it, we have an in-depth tutorial here.

Top 11 online payment methods for SureCart

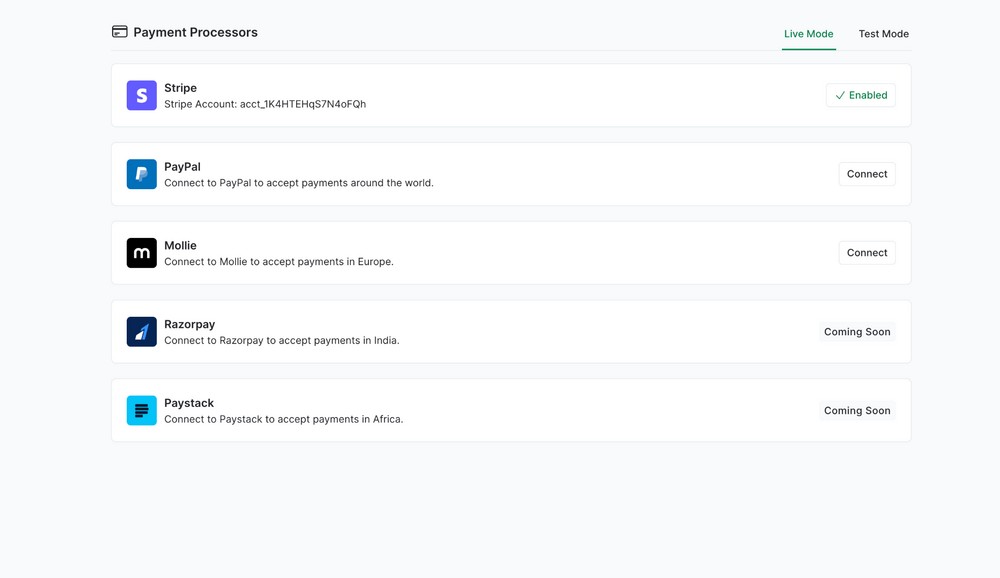

SureCart supports a massive range of payment methods through multiple payment processors.

While you can enable Stripe, Mollie and PayPal at the moment, more payment processors are in the pipeline, such as Razorpay and Paystack.

Here are some of the most popular online payment options you can offer in your SureCart store.

1. Digital wallets

Digital wallets are easy, fast, and safe. Users can save their debit and credit card information once and never have to do it again.

You just have to click a button on a checkout page and voila!

Juniper Research reports that 60% of the global population will use digital wallets by 2026.

Whether you want to purchase from your local or global eCommerce store, digital wallets are viable eCommerce payment options.

Fortunately, SureCart supports digital wallets. Just enable Stripe and you will have the most popular digital wallets available right away.

Stripe supports:

- PayPal

- AliPay

- Apple Pay

- Cash App Pay

- Google Pay

- GrabPay

- WeChat Pay

- Link

Pros

- Drastically improve the consumer experience

- Better fraud protection

- Transfer money in seconds with a single click

Cons

- Digital wallets with two-factor authentication require you to carry your phone everywhere

If your target audience is tech-savvy, including a digital wallet option is essential.

2. Credit/Debit cards

Credit and debit cards are still a popular choice of payment online. Their global familiarity is an advantage as most consumers are comfortable paying using cards.

A 2021 indicates that credit cards had 21% market share. As eCommerce grows worldwide, their penetration has reached 28%, according to Skril.

The same report reveals that debit cards have 36% market share.

You should ideally integrate the following credit/debit cards into your eCommerce store:

- Visa

- Mastercard

- American Express

- Discover

- Diners Club

- JCB

- China UnionPay

Pros

- Debit/credit cards are widely known and trusted

- Consumers tend to buy impulsively with credit cards

- Cards are relatively inexpensive to integrate

Cons

- Cards can have higher processing costs, reducing margins

3. Cartes Bancaires

Cartes Bancaires is the biggest and most popular payment method for online merchants in France, one of Europe’s largest eCommerce markets.

There are over 60 million cardholders that trust Cartes Bancaires as it’s backed by Visa.

When you enable Stripe in SureCart, a Cartes Bancaires’s logo appears on the checkout page whenever consumers access your website from France.

For consumers, it is a similar experience to Visa or any other card. It’s as simple as filling out the information and authorizing the payment.

One of the benefits of this payment method is that merchants don’t have to wait long to receive payments.

Cartes Bancaires has no hidden charges and merchants only pay for successful transactions.

Pros

- Being a secure method creates more trust for consumers

- Lower chargeback rates than Visa and Mastercard

- Lower dispute rates due to stringent laws that favor merchants

Cons

- Most disputes result in the immediate deduction of funds

4. JCB (Japan Credit Bureau)

If you target consumers in the Asia Pacific region, you should prioritize the JCB payment method over others.

JCB is the largest credit card brand in Japan, responsible for over 25% of electronic transactions. It issues credit and debit cards for different needs.

Good news is that the credit card does not limit itself to Japan. It is accepted in 24 countries with over 150 million cardholders worldwide.

Countries include Russia, Germany, Austria, Spain, South Korea and Taiwan.

Just recently, JCB entered the Indian market and signed contracts with Saudi banks for a more diverse user base.

Pros

- Available in 24 countries and counting

- Flexible refund policy

- Low foreign currency conversion fee

Cons

- Being a growing card network, fewer global partners work with JCB

5. Meses sin intereses

Meses sin intereses, or months without interest, is a payment scheme that allows consumers to split payments over up to 24 months.

Meses sin intereses is available to consumers in Mexico on their credit cards. They can easily purchase high value items and pay in installments according to the duration they choose at the time of purchase.

There are no processing fees or interest charges. This makes it a viable option for merchants as it encourages consumers to buy more.

This is a risk-free method for merchants since they receive full payment just like a normal sale. It is the customer’s bank that collects the funds over time.

Pros

- The feature is available on several credit cards

- Remove price barriers and attract more consumers

- Merchants don’t need to deal with payment complexities

Cons

- Support for the Mexican currency only

6. Bank redirects

In cases where customers don’t usually have credit cards, bank redirects can be used as an alternative payment method.

In countries such as Germany, the Netherlands and Malaysia, bank redirects facilitate half of all eCommerce transactions.

The Pay Now button redirects customers to their bank to authorize payment for the item they purchased like with a bank transfer.

Generally banks use two-factor authentication via SMS to verify the transaction.

Upon successful authorization, the bank will notify the customer and return to the merchant’s site for payment confirmation.

With Stripe, you can add any bank to the bank redirect payment method using a single line of code.

Banks that accept bank redirects include:

- BLIK (Poland)

- Bankcontact (Belgium)

- EPS (Austria)

- giropay (Germany)

- iDEAL (Netherlands)

- Przelwey24 (Poland)

- Sofort (Austria, Belgium, Germany, Italy, the Netherlands, Spain, Switzerland)

Pros

- Merchants get paid quickly due to instant settlement

- Adoption fees are low

- High level of trust when integrated with local banks

Cons

- There is a high dependency on connectivity between the eCommerce site and the banking server

7. Buy now, pay later

Buy Now, Pay Later (BNPL) is another popular payment method offered online. It allows users to make purchases even if they are unable to make the payment upfront.

Consumers can purchase an item immediately and pay later in installments.

It’s a popular payment method that is projected to grow to $90 billion by 2029, according to Fortune Business Insight.

As a store owner, you only need to integrate the BNPL service provider into your website. It’s easy to do through Stripe.

On the checkout page, when a user sees the logos of Affirm, Afterpay, or Klarna, they will know they can use an installment option.

When a user clicks on the desired logo, the BNPL service provider will walk them through essential steps and allow them to choose an installment plan.

eCommerce stores are paid in full up front. The rest is a contract between the consumer and the BNPL service provider.

Pros

- Merchants get full payment upfront

- Allow selling high value products and improving conversions

- Available in many countries

Cons

- Buy now pay later financing may not be available on all purchases such as subscriptions

Here are some popular BNPL players you can integrate into your website through SureCart:

- Affirm

- Afterpay/Clearpay

- Klarna

Buy Now, Pay Later is available in a number of countries including Canada, United States, France, Spain, Belgium, Germany, Greece, Sweden, the United Kingdom and many others.

8. Bank debits

If you sell high value items on your business site such as premium courses, bank debits can be a nice addition to the payment methods on your website.

The benefits of this payment system include lower transaction costs, fewer payment failures and minimal fraud and chargebacks.

With bank debits, merchants can directly pull payments from customers’ bank accounts. A merchant can debit a customer’s account for one time or for recurring payments with a single permission from the customer.

Just like other payment options, bank debit appears on the checkout page along with other payment methods.

To start the process, customers must enter their bank account details and allow the merchant to debit their account. The process is called mandate and is very popular in some regions.

Pros

- Ideal for businesses selling high value items

- Less chances of payment failure as merchants get prior customer approval

- Low transaction cost

Cons

- Payments usually show up in 3 – 5 business days in the merchant’s account

Some of the most popular global bank debit methods SureCart supports are:

- Bacs direct debit

- FPX

- SEPA direct debit

- Canadian pre-authorized debits

- ACH direct debits

- BECS direct debit (AU)

Bank debits are popular payment methods in the USA, Canada, Australia and several European countries.

9. Vouchers

Voucher-based payment systems are the middle ground between cash and digital payments. It’s a hybrid solution where a customer is issued a voucher during checkout.

After a successful checkout, customers have to take the next step.

They take the voucher to a physical location such as a retail counter, ATM or convenience store and pay cash to complete the purchase.

In most cases, the voucher will consist of a set of codes along with a unique transaction number. Customers can use a printed voucher or an e-voucher when paying.

Vouchers have an expiration date, so customers need to make sure they complete the transaction as soon as possible.

The merchant will initiate the delivery of the items as soon as they receive the payment.

Some of the famous payment networks are:

- Boleto

- OXXO

- Konbini

Pros and cons of voucher based payment systems:

Pros

- Helpful in places where cash is the only option

- Verification codes keep transactions safe

- With vouchers, more low-income buyers join the network

Cons

- It takes a day for payments to arrive

This type of payment system is very common in countries where bank accounts and credit cards are not widely available.

The practice is common in countries such as Mexico, Brazil and Egypt, to a lesser extent, Japan.

10. Real-time payments

Real-time payments such as PromptPay address a core problem merchants face. This payment method promises immediate funds transfer from buyer to seller.

There are several other benefits for merchants. Once received, the payment cannot be retrieved as there is no hold policy.

Unlike other payment methods that require merchants to wait for a few days, they can use payments immediately after the transfer.

According to Juniper Research, the volume of real time payments will exceed $116 billion by 2026, a significant increase from $4 billion in 2021.

This shows just how fast this payment method is becoming one of the preferred payment options for merchants in the markets where it is available.

With SureCart you can effortlessly integrate PayNow (Singapore) and PromptPay (Thailand) on your business site.

Pros

- It’s cost effective

- It replaces paper checks that are a hassle to manage

- Quick cross-border payments

Cons

- Since real-time payments cannot be refunded, networks must develop processes to prevent fraud

Currently, real-time payments are being adopted in over 12 countries, mostly in the Asia-Pacific region.

Among them are China, New Zealand, Australia, India, South Korea, Philippines, Bangladesh, Malaysia, and others.

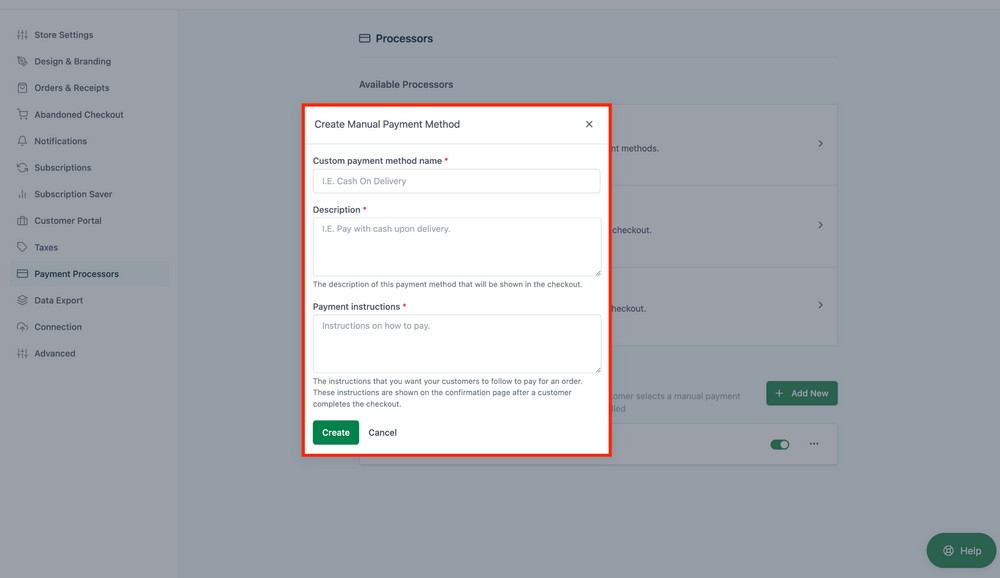

11. Manual payment methods

If your target audience is from a region where only a manually configured custom payment method works, SureCart allows you to configure anything you need.

For example, cash on delivery (COD) is a popular payment method where credit card penetration is low or customers prefer COD.

Similarly, other options include money order, check, bank transfer, or email money transfer.

Final thoughts

Online businesses are full of opportunities. You can take your store to new heights, sell across borders and make more profit by making smart choices.

Thanks to support for multiple payment methods SureCart offers. Your customers can purchase from anywhere in the world, using whatever payment method they are most comfortable using.

With SureCart, adding payment methods to your online business is as easy as 1,2,3. Which ones will you add?

Don’t forget to share your experience in the comments.

Disclosure: This blog may contain affiliate links. If you make a purchase through one of these links, we may receive a small commission. Read disclosure. Rest assured that we only recommend products that we have personally used and believe will add value to our readers. Thanks for your support!

Recommended Articles

10 Best selling digital products that can make you money

8 checkout page design tips and strategies to boost sales